Call Us With Your Solar Questions: (845) 262-4480

Westchester Businesses & Nonprofits Win Big With Solar

Some organizations will save $2 million+ over the lifetime of their solar system

Westchester County NY is not only known for its picturesque landscapes and vibrant communities but also for its forward-thinking approach to sustainable energy practices. The County has emerged as a beacon for businesses and nonprofits looking to make the switch to solar power. Thanks to a combination of federal and state incentives, Westchester County offers a compelling case for organizations to embrace solar energy, not only for environmental reasons but also for substantial financial benefits.

The NYSERDA NY-Sun Rebate Changes Everything

Economics for solar projects in New York State are largely influenced by incentives available from the New York State Energy Research and Development Authority (NYSERDA) through the NY-Sun program. For businesses and nonprofits located in NYSERDA's Con Edison Westchester region, rebates are at a remarkable $1 per watt meaning that a 100kw system receives an upfront rebate of $100,000 from NYSERDA via Con Edison.

...but the NY-Sun rebate is going away

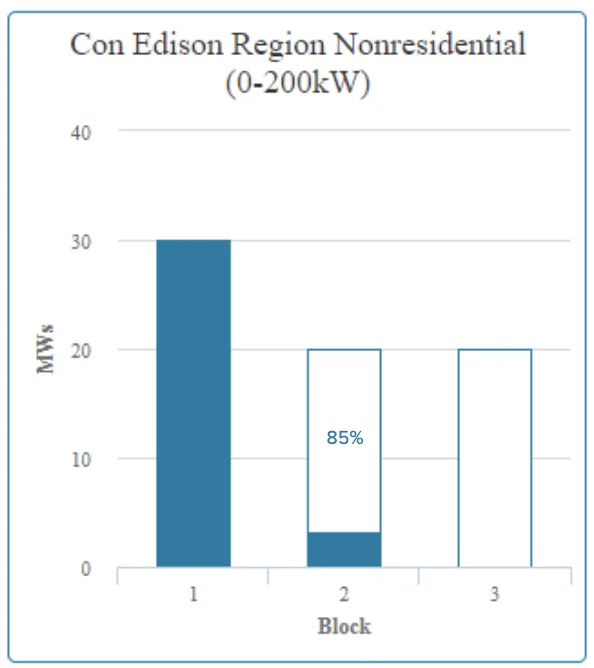

It must be noted that the NY-Sun rebates won’t last much longer. In fact, the NY-Sun incentives are structured under a “declining block structure,” whereby the $/watt incentive rate available to projects declines as available capacity in a given block is reserved by other organizations. The Con Edison Nonresidential blocks have already been reduced by 20% of their original value. The third block will see the $/watt rebate drop to $.80 (from $1 in block 2; block 1 rolled out with a $1.25/watt rebate). As you can see from the following chart, we are in the middle of block 2 and block 2 could be tapped out in the next several months

The ‘Direct Payment’ Provision of the Inflation Reduction Act

Another significant incentive driving the adoption of solar power in Westchester County is the Federal Investment Tax Credit (ITC). The ITC allows businesses and nonprofits to claim a tax credit equal to 30% of the total solar installation cost. What makes this incentive particularly appealing for nonprofits is that they can receive the ITC as a direct payment if they lack taxable income. This means that even organizations that do not have a tax liability can still benefit from this substantial financial boost. The direct payment provision along with the truly remarkable rebates available through NYSERDA’s NY-Sun program is a complete game changer for nonprofits. It allows them to go solar with minimal upfront costs and realize millions of dollars in lifetime savings…taking a big bite out of annual operating costs.

A Solar Success Story - $2 Million in Savings

To illustrate the substantial savings and benefits of these incentives, let's take a look at a real-world case study involving a synagogue in Westchester County. This synagogue decided to embrace solar energy to both reduce its carbon footprint and lower its energy costs.

The synagogue is evaluating a 165 kW solar energy system with an estimated cost of $350,000. Thanks to the Federal Investment Tax Credit, they will receive a direct payment of 30% of the cost of their system or $105,000. Additionally, the NYSERDA NY-Sun rebate provides them with an additional $206,000, given the size of their system. Considering these incentives, the synagogue's out-of-pocket costs for their solar installation will be dramatically reduced making the decision to switch to solar financially attractive.

Here’s the best part…

Over the estimated 25-year lifespan of their solar system, the synagogue is projected to save over $2 million in energy costs. These savings not only enhance the organization's financial stability but also enable it to spend money on the issues and causes that matter most to its congregation.

A Bright Future for Solar in Westchester County

Westchester County has created an environment where businesses and nonprofits are incentivized to adopt solar energy on a grand scale. The combination of the Federal Investment Tax Credit and the NYSERDA NY-Sun rebate makes transitioning to solar power an economically sound decision. As demonstrated by the case study above, organizations in Westchester County can expect substantial savings and a brighter, more sustainable future by making the switch to solar energy. Any size business or nonprofit can benefit from going solar (provided that their building is a good candidate for solar). Not only does a business or nonprofit gain the benefits of renewable, affordable clean energy but it will also experience an improved bottom line by cutting operating costs, locking in energy rates, & taking advantage of extremely lucrative rebates, tax credits & asset depreciation.

To summarize the above…

Remarkable incentives currently exist for nonprofits from the Federal government and New York State (NYSERDA NY-Sun program).

Out-of-pocket costs are as low as 10% of the total system cost after rebates & incentives.

Some Westchester organizations can save $2 million+ over the lifetime of their system.

System payback periods: under one year.

NY-Sun rebates are diminishing. Time is of the essence.

The Local Solar Energy Foundation will conduct a free analysis based on your location and utility usage over the past 12 months.

Businesses and nonprofits can go solar at little to no upfront cost giving them the opportunity to reduce energy costs so they can focus funds on their mission-critical work.

With the right installer, the whole process is 100% turnkey - from permits to installation.

With these remarkable incentives in place, it's clear that Westchester County is leading the charge toward a greener, more energy-efficient tomorrow.

For a free consultation and to find out exactly how much your organization can save by switching to solar power, contact Mike Corso, President of the Local Solar Energy Foundation at (845) 262-4480